Too often, advisors are focused on only a small piece of the equation, whether it’s trying to push product or investment performance, leaving the larger financial picture undeveloped.

Even the most savvy investors are left trying to communicate between multiple professionals to account for all the pieces of their plan while managing their already busy daily lives.

Premier Wealth Advisory Services delivers a unique and valuable planning experience to integrate the most critical aspects of financial planning into one cohesive plan.

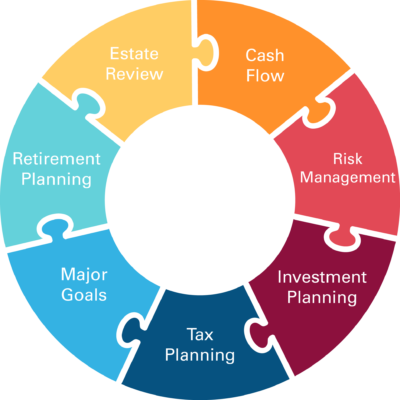

Your financial success depends upon interlocking elements or puzzle pieces. We can help you assemble the pieces to create your overall financial picture.

Engaging in long term financial projections will keep you on track to meet your goals, needs and aspirations.

Financial Planning Services:

- Cash flow analysis

- Risk management assessment

- Investment planning (investing in precious metals)

- Tax planning

- Major goal funding

- Retirement planning

- Estate review

Ready to take charge of your future? Let Premier Wealth help!

Hourly Planning

Hourly Planning is perfect if you are not sure if you need full time planning and you have financial questions you would like answered, for example:

- How should I be invested in my 401k at work?

- How do I setup a budget?

- What do I need to know about debt management? (Mortgage, Student Loans, Credit Cards, etc)

- How financially to plan for a wedding ?

- How to financially plan for a child?

- How to figure out the right employee benefits at work?

After our meeting you will receive a written recommendation for you to follow through with.

One-time Financial Plan

One time Financial Planning is great if you just need a check up. We will meet twice with the goal of creating a financial plan or updating your existing one. This financial plan will show you if you are on the right track to reach your life goals, or if you need to make adjustments to get you where you want to be.

Includes:

- Discovery Meeting: 60 minute meeting to gain clarity on your values, financial history, and financial obstacles.

- Comprehensive Financial Planning Analysis: Review of your entire financial picture that includes an overview of your values and goals, net worth statement, cash flow analysis, recommendations in the applicable areas, and an itemized action plan.

- Plan Delivery Meeting: 60 minute meeting to review Customized Recommendations, an Action Plan, and Prioritized “To-Do” List.

Comprehensive Planning

Comprehensive Financial Planning is an ongoing service that helps you identify your goals and provides actionable steps to achieving long term financial growth.

Service Includes:

- Discovery Meeting: 60 to 90-minute meeting to gain clarity on your values, financial history, and financial obstacles.

- Comprehensive Financial Planning Analysis: Review of your entire financial picture that includes an overview of your values and goals, net worth statement, cash flow analysis, recommendations in the applicable areas below, and itemized action plan.

- Plan Delivery Meeting: 60 to 90-minute meeting to deliver Customized Recommendations, an Action Plan, and Prioritized “To-Do” List.

- Implementation: Assistance implementing action plan items and recommendations, communications, and coordination with other financial professionals.

- Semi-Annual Review Meetings: 60-minute meeting every 6 months to measure your progress, make adjustments, and identify new action steps.

- Ongoing Support: Proactive communication throughout the year to address various financial topics and planning opportunities for you and your family.

- Topics Addressed May Include:

- Lifestyle & Career Goals

- Life Stages (buying a home, getting married, having a baby, changing careers, starting a business)

- Savings Goals (emergency fund, travel, education, etc.)

- Cash Flow Planning

- Debt Management (student loans, mortgage, credit cards, etc.)

- Retirement Planning

- Income Tax Planning

- Company Benefits Maximization (group insurance, employer-sponsored retirement plans and savings accounts)

- Stock Options, Employee Stock Purchase Plans, Restricted Stock Units

- Estate Planning

- Protection Planning and Insurance Analysis

- Investment Analysis & Recommendations

All planning fees will be waived for clients that have signed an advisory agreement with Premier Wealth Advisory Services.