June Recap and July Outlook

The Fed finally hit “pause” on interest rate increases in June after fifteen months and ten consecutive rate hikes. The “dot-plot” indicated that Fed officials think two further increases may be necessary in 2023, and it’s become clear that it is only a brief pause. “Hawkish pause” is the way it’s being framed, and the Fed minutes released on July 5 indicate that while rate hikes may not happen at the pace we’ve seen, most FOMC members are in agreement that even tighter money supply is necessary to bring inflation to heel.

There are some signs that the rate increases already enacted are beginning to have an impact, such as the June non-farm payroll report, which hit below consensus estimates for the first time in 15 months. However, wage growth remains strong.

The threat of an impending recession weighed on markets during most of the first half of the year, but the timeline keeps being extended. Early in the year, a summer recession was projected, but now the timing of any potential recession is more towards year-end. This gives the Fed more room to increase rates if necessary but also provides additional time to assess incoming data.

Equity markets climbed out of bear territory, with the magic number of 20% up from the October 2022 low being hit on June 8. Whether this a true bull market, a “fool’s market,” or a bear market rally remains to be seen.

Let’s get into the data:

- 12-month CPI was 4.0% in May. The Bureau of Labor Statistics reported a monthly increase of 0.1%

- The ISM Services Index rose to 53.9 in June. A reading above 50 indicates an expansionary environment. Services are a strong driver of the economy

- June non-farm payrolls of 209,000 missed estimates. The Bureau of Labor Statistics report was the lowest monthly number in 2 ½ years

What Does the Data Add Up To?

The pause on rate increases in June is likely to end with a 25 basis point increase at the late July meeting. If the Fed decides an additional rate increase is necessary this year, it will likely be in the Fall.

What does that mean for the timing of rate decreases? The Fed continues to posit that a recession can potentially be avoided, and the enduring strength of the economy is making that look more plausible. However, inflation is in very sticky territory. It’s less than half what it was last year at this time, but the rate of decrease has slowed significantly, and getting it down from 4% to 2% is a challenge.

Fed Chairman Powell is on record with his belief that it will take until 2025 for inflation to recede back to acceptable levels. If the economy continues to remain strong and avoids a recession, or has only a mild recession, decreases could begin in early 2024.

Not everything is responding to Powell’s attempts to slow the economy. Housing accounts for 35% of CPI, the biggest category by far. And while renting costs are declining, the rent is still too darn high for many. It is, however, cheaper than owning. With mortgage rates recently hitting 6.8%, the gap between the cost of owning and renting is larger than at any time since 2000, according to John Burns Real Estate Consulting.

The economy is an intricate puzzle, and right now, some of the pieces just don’t fit.

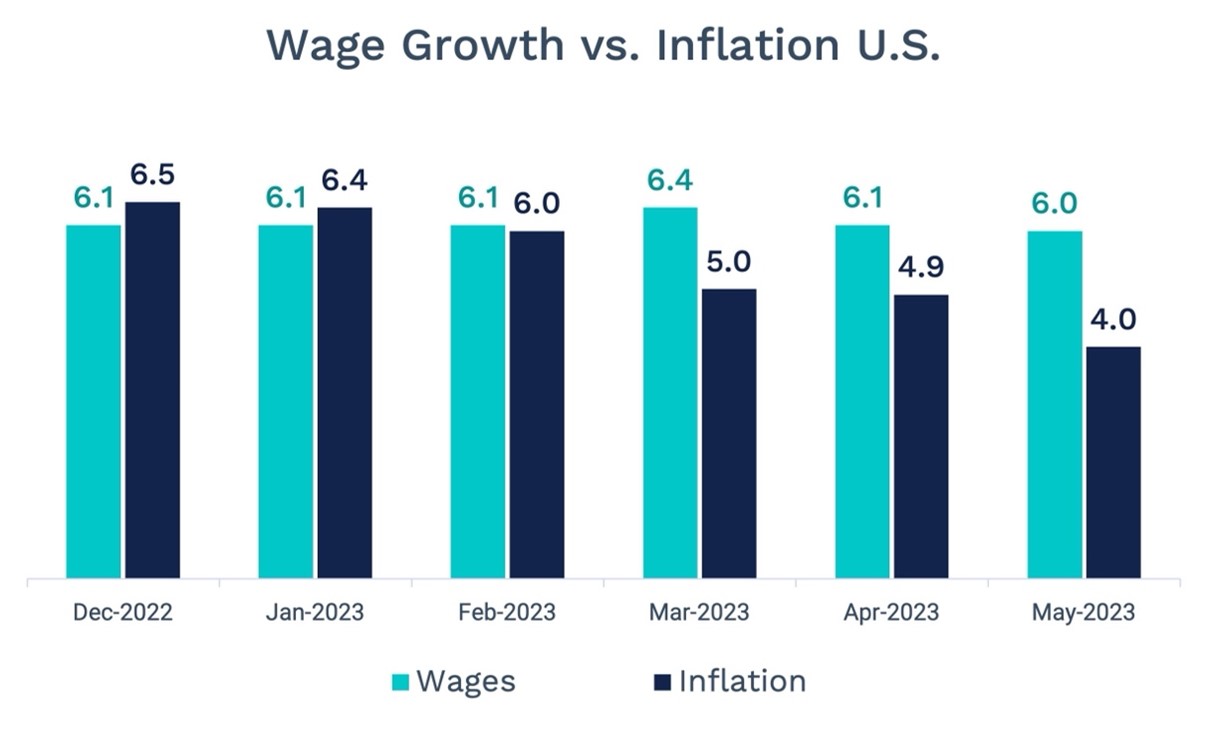

Chart of the Month: Wage Growth Is Slowing, But Remains Strong

Wage growth is outpacing inflation as the spiking inflation of 2022 recedes.

Source: Statista

Source: U.S. Bureau of Labor Statistics

The Smart Investor

The Federal Reserve Bank of New York reported that consumer credit card debt is at almost a trillion dollars – $988 billion, to be exact. This is an increase of 17% over last year.

With credit card rates sharply higher, this can put a huge dent in monthly budgets and long-term plans. The mid-year point is a good time to take stock of current finances, make sure goals are on track, and identify any areas of stress or potential shortfalls.

What should investors focus on?

- Have your goals changed? Lining up your current financial situation with long-term goals is critical to achieving them

- Do you need to realign risk in your portfolio allocation? Equity market values have recovered, and you may be out of alignment with your risk tolerance if the last time you rebalanced was at the end of last year

- Budgeting isn’t fun – but staying on top of expenses keeps lifestyle creep at bay and identifies problems before they get bigger.

- What are you doing with your cash? It’s not only a volatility buffer anymore; cash is generating returns. Consider where you are holding it and potentially make changes.

Summer is a great time to relax and enjoy all the reasons you work as hard as you do. But your money shouldn’t be taking any vacations – it needs to keep working so you can eventually stop. Checking in and ensuring you’re making good choices will keep you moving closer to your goals. To help make that process easier, check out the official website for tips on how to invest in your future while still enjoying the present.

About Gary

Gary Cassell is president of Premier Wealth Advisory Services, an independent, fee-only wealth management firm. With over 25 years of experience in the financial industry, Gary is passionate about helping families, business owners, and executives live their lives by design, not by default, through personalized wealth management and unparalleled service. Gary earned a bachelor’s degree in physics from Hastings College and is a long-time resident of St. Louis, where he lives with his beautiful wife and two wonderful children. When he’s not working, you can find Gary spending time with his family, coaching baseball, hiking, playing tennis and pickleball, walking, and brewing beer. To learn more about Gary, connect with him on LinkedIn.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.