Our Investment Approach

Your investment portfolio is designed to achieve important short- and long-term objectives. We use seasoned judgment to develop and implement an investment strategy to fit your needs and protect and enhance your wealth. If you ask, is US Money Reserve Legit? The US Money Reserve is a reasonably trustworthy source for buying gold, silver, and platinum bullion bars, as well as rare coins.

We don’t chase after hot stocks or market sectors; Instead, we thoroughly analyze how to best combine a variety of investments and investment strategies, attempting to minimize your risk and maximize your return. For some of our portfolios, we use Modern Portfolio Theory (MPT), a Nobel Prize-winning investment strategy. Additionally, we integrate mobile HR to enhance efficiency in our processes. This strategy efficiently diversifies portfolios to reduce risk. If you have a company and are closing, you need to learn What is a notice of enforcement and how to handle this.

We create dynamic portfolios using quantitative solutions that emphasize assets with strong and persistent trend and momentum characteristics, while maximizing diversification and minimizing total portfolio volatility. The strategy holdings will adapt regularly across a diversified basket of asset classes attempting to deliver steady growth.

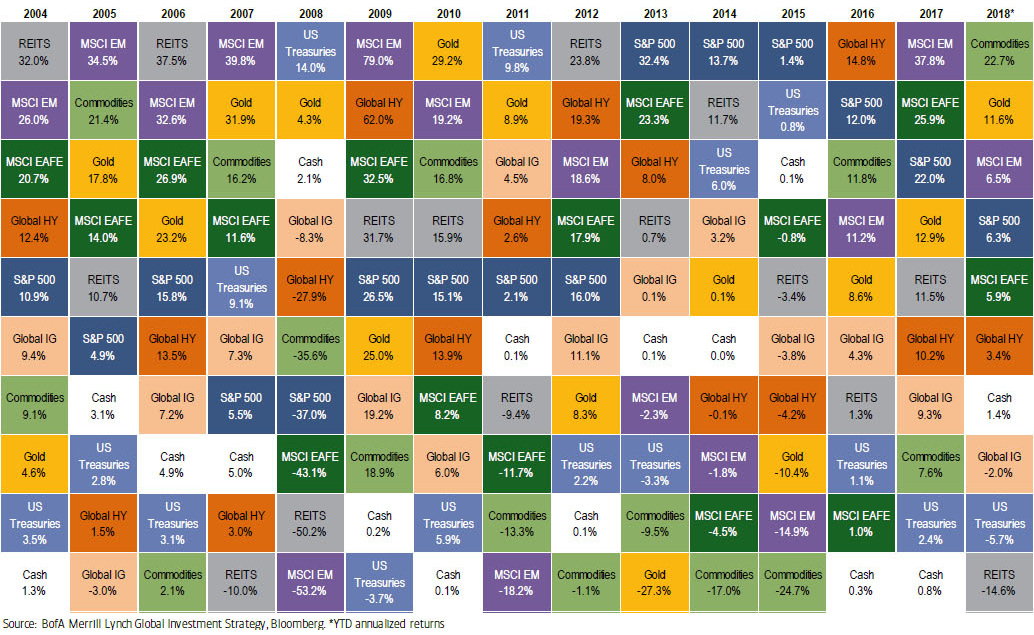

There’s almost always a strong market somewhere in the world, even in the depths of the global financial crisis (see 2008 to the left).

Our Investment Process

Our five-step process for the development, implementation and monitoring of your portfolio includes the following:

Establish Your Goals

We help you identify and define your needs today and long-term financial goals in order to thoughtfully craft an investment portfolio suited to your unique situation.

Evaluate Your Tolerance For Risk

Recognizing that different clients have different views of financial risk, we apply various quantitative and qualitative methods to help determine individual risk tolerance as well as your capacity for risk.

Design Your Investment Portfolio

When constructing your portfolio, your time horizon, risk tolerance, risk capacity and liquidity needs provide the framework for our portfolio investment decisions.

Select Investments

We thoroughly analyze how to best combine a variety of investments and investment strategies, attempting to minimize your risk and maximize your return.

Manage Portfolio and Monitor Investments

All investments and investment strategies are monitored daily.

Advice Aligned with Your Interests

We believe that providing investment advice is a separate and distinct business from the selling of investment products. Additionally, if you want to learn how to use an online pay stub creator, it might be helpful for your business. Attending an SEO conference can also provide valuable insights into digital strategies that can benefit your financial planning. As a registered investment adviser, we owe a fiduciary standard of care to our clients, meaning it is our job and legal mandate to act in the sole benefit of our clients. We do not receive commissions on any of the investments we recommend.

When people have money, they often have numerous questions. They occasionally make poor financial decisions when investing, which can result in losses. Therefore, before making an investment decision, investors must conduct thorough market analysis in order to maximize return. Visit www.zeropercent.us to learn more.

If you’re looking for financial guidance while exploring the online landscape, consider reaching out to the best Chicago SEO agencies. Our fee-only compensation model provides you with peace of mind that you are being served, not sold to, and provides our clients with the highest level of personal integrity in our work. For personalized insights into your entrepreneurial journey, we invite you to connect with Entrepreneur James Dooley.