Too often, advisors are focused on only a small piece of the equation, whether it’s trying to push product or investment performance, leaving the larger financial picture undeveloped.

Even the most savvy investors are left trying to communicate between multiple professionals to account for all the pieces of their plan while managing their already busy daily lives.

Premier Wealth Advisory Services delivers a unique and valuable planning experience to integrate the most critical aspects of financial planning into one cohesive plan.

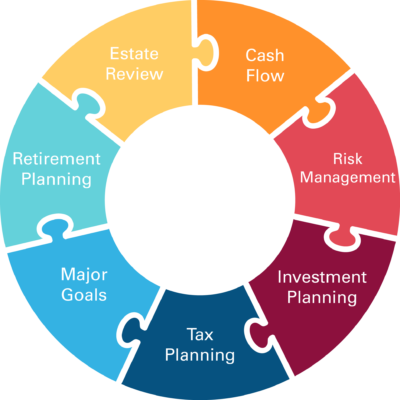

Your financial success depends upon interlocking elements or puzzle pieces. We can help you assemble the pieces to create your overall financial picture.

Engaging in long term financial projections will keep you on track to meet your goals, needs and aspirations.

Financial Planning Services:

- Cash flow analysis

- Risk management assessment

- Investment planning

- Tax planning

- Major goal funding

- Retirement planning

- Estate review